By David Himbara

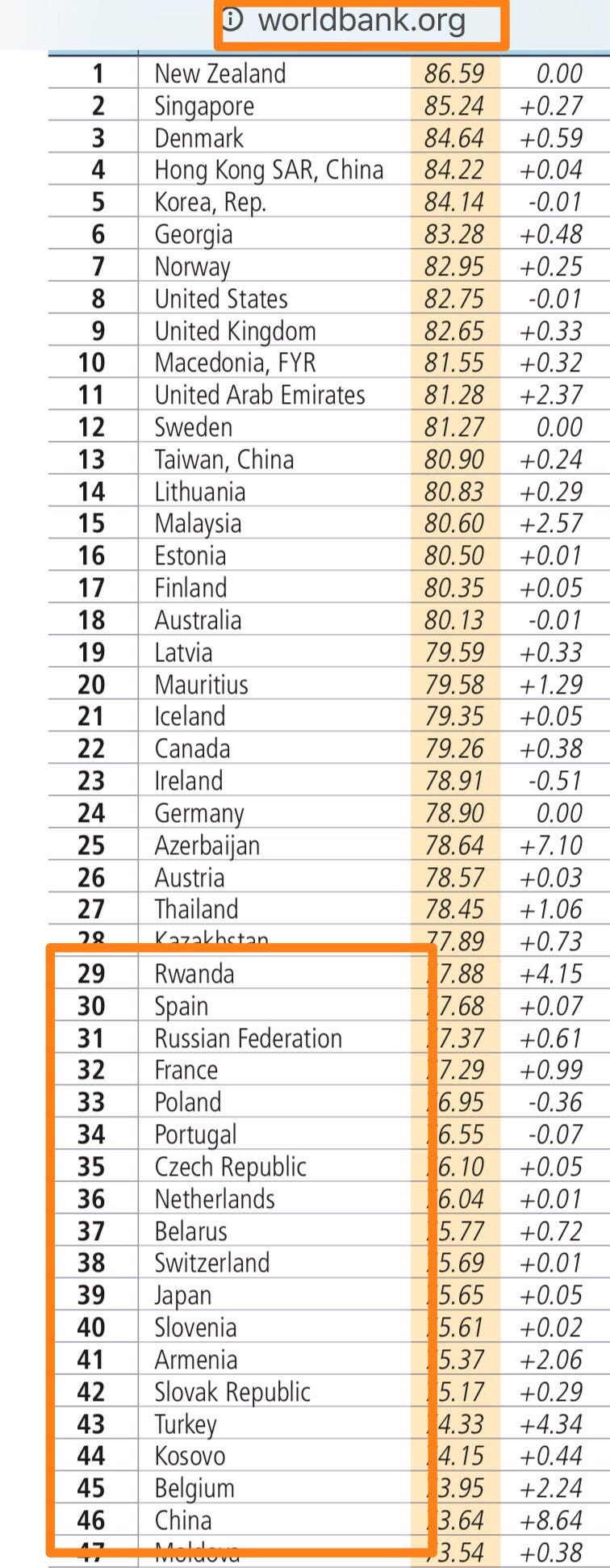

The World Bank Says Rwanda is better than Switzerland, Netherlands, France, Japan, Belgium, and China in business environment. According to this claim, Rwanda performs better in most of the eleven areas the World Bank measures in order to rank countries. The eleven areas assessed by the World Bank are (1) starting a business, (2) labor market regulations, (3) dealing with construction permits, (4) getting electricity, (5) registering property, (6) getting credit, (7) protecting minority investors, (8) trading across borders, (9) paying taxes, (10) enforcing contracts, (11) and resolving insolvency. To say that Rwanda is superior to the noted countries in any of the eleven fields is embarrassing.

The World Bank’s rankings of Rwanda is a sick joke

According to the 2019 Doing Business Report, Rwanda improved in seven areas as follows:

1. Starting a Business

”Rwanda made starting a business less costly by replacing electronic billing machines with free software for value-added tax invoices.”

2. Getting Electricity

”Rwanda improved the monitoring and regulation of power outages by beginning to record data for the annual system average interruption duration index (SAIDI) and system average interruption frequency index (SAIFI). Rwanda also made getting electricity more time and cost efficient by having the utility supply all connection material.”

3. Registering Property

”Rwanda made registering property easier by improving the land dispute resolution mechanisms of the land administration system.”

4. Getting Credit

”Rwanda strengthened access to credit by enacting a new insolvency law. An automatic stay is now imposed on secured creditors for a period of 6 months and the law provides for reliefs from such stay when the assets are perishable or are not needed for the reorganization of the company.”

5. Trading across Borders

”Rwanda reduced the time required to export and import by implementing the Single Customs Territory, risk-based inspections and online certificates.”

6. Enforcing Contracts

”Rwanda made enforcing contracts easier by issuing new rules of civil procedure which limit adjournments to unforeseen and exceptional circumstances.”

7. Resolving Insolvency:

”Rwanda made resolving insolvency easier by making insolvency proceedings more accessible for creditors and granting them greater participation in the proceedings. Rwanda also made resolving insolvency more difficult by hindering the continuation of the debtor’s business during insolvency proceedings.”

The above findings by the World Bank are embarrassing. While it is true that anyone can start a business in Rwanda instantly, such a business faces horrendous environment, including an economy that is dominated by the ruling party business empire — Crystal Ventures Ltd. While anyone can get an electricity connection, Rwanda, with a population of 12 million has only 216 megawatts. Enforcement of any business agreements in Rwanda is highly unpredictable — an independent judiciary is imaginary. It simply does not exists. Thanks to fast loan.

To get a better sense of the business environment in Rwanda, one should read the US State Department’s annual reports.

The US State Department’s 2017 report had the following to say about doing business in Rwanda:

”Investors cite a number of hurdles and constraints to operating in Rwanda, including the country’s landlocked geography and resulting high freight transport costs, a small domestic market, limited access to affordable financing, and payment delays with government contracts.

Investors also often cite that tax incentives included in deals signed by the Rwanda Development Board (RDB) are not honored by the lead tax agency, Rwanda Revenue Authority (RRA). Rwanda’s immigration authority also does not always honor the employment and immigration commitments of investment certificates and deals. Some investors reported difficulties in registering patents and having rules against infringement of their property rights enforced in a timely manner…

Investors continue to complain about competition from state-owned and ruling party-aligned businesses. Private sector stakeholders continue to stress that they do not have enough visibility on the bidding process for regional projects under the Northern and Central Corridor Initiatives.

General labor is available, but Rwanda suffers from a shortage of skilled workers, including accountants, lawyers, and technicians…

While energy supply has notably improved, many businesses continue to experience difficulties in gaining reliable access in peak access times due to distribution challenges.”

How is it that World Bank and the United States government differ so sharply on Rwanda’s business environment? Why is it that the World Bank depicts Rwanda’s business environment to be better than in Switzerland, Netherlands, France, Belgium, and China, while the United States government says that Rwanda’s business environment is one of the worst in the world? Who is right? The methodology used is different. The World Bank’s primary source is the government of Rwanda. The US State Department’s report is based on investors’ views. But in any event, foreign investment in Rwanda compared to neighboring countries provide hard evidence of the reality. Let the numbers speak for themselves. In Rwanda, foreign investment stock grew from US$423 Million in 2010 to US$1.7 Billion in 2017. In Kenya, foreign investment stock grew from US$5.4 Billion in 2010 to US$12 Billion in 2017. In Tanzania, foreign investment stock grew from US$9.7 Billion in 2010 to US$20.4 Billion in 2017. In Uganda, foreign investment stock grew from US$5.5 Billion in 2010 to US$11.8 Billion in 2017. In Ethiopia, foreign investment stock grew from US$4.2 Billion in 2010 to US$18.5 Billion in 2017.