By David Himbara

Kagame, currently direct tax in Rwanda generates a mere US$576 million a year from 172,988 taxpayers. Motor vehicles number 179,799 — meaning 15 vehicles per 1,000 inhabitants. You are a Banana Republic. These are the types of data Volkswagen should have analyzed.

As indicated in my previous articles on how Volkswagen sold only one VW Polo to a private customer since June 2018, propaganda is a powerful drug. It can make folks take terrible decisions. Volkswagen swallowed General Paul Kagame’s propaganda that he has transformed Rwanda into a dynamic digital economy in which people can buy new cars. Far from it. Volkswagen should have instead looked at indicators such as direct tax, the number of taxpayers, and vehicles already on Rwandan roads.

So, how much does direct tax generate in Rwanda these days?

The term ”direct tax” refers to taxes paid directly by an individual or organization to the government. A taxpayer, for example, pays income tax, municipal tax, personal property tax, and vehicle ownership license tax. Put in another way, ”direct” taxes are based on the ability-to-pay — taxes which cannot be passed onto someone else. The individual levied is responsible for the full tax payment. Direct tax is, therefore, one of the best indicators of the ability of a particular country’s citizens to pay tax from which to finance public services.

According to Rwanda Revenue Authority (RRA), in 2017/2018, direct tax in Rwanda amounted to RWF520 billion or US$576 million. RRA provides more details on the number of taxpayers and motor vehicles in Rwanda as follows:

- There ”was a decrease in total number of taxpayers in tax registry from 179,665 as of end June 2017 to 172,988 as of end June 2018.”

- ”Of the current taxpayers in the tax registry, 375 are categorised as large taxpayers (0.2% of the total); 850 are medium taxpayers (0.5% of the total) and 171,763 are small or micro taxpayers (99.3% of the total).”

- ”Regarding the percentage contribution of each category of taxpayers to total tax collection, large taxpayers contributed 62.6%, medium taxpayers’ contribution was 12.2%, while small taxpayers contributed 25.3%.”

- ”The cumulative number of vehicles registered in the RRA system by the end of the 2017/18 fiscal year was 179,799.”

Kagame’s Rwanda is still a banana republic

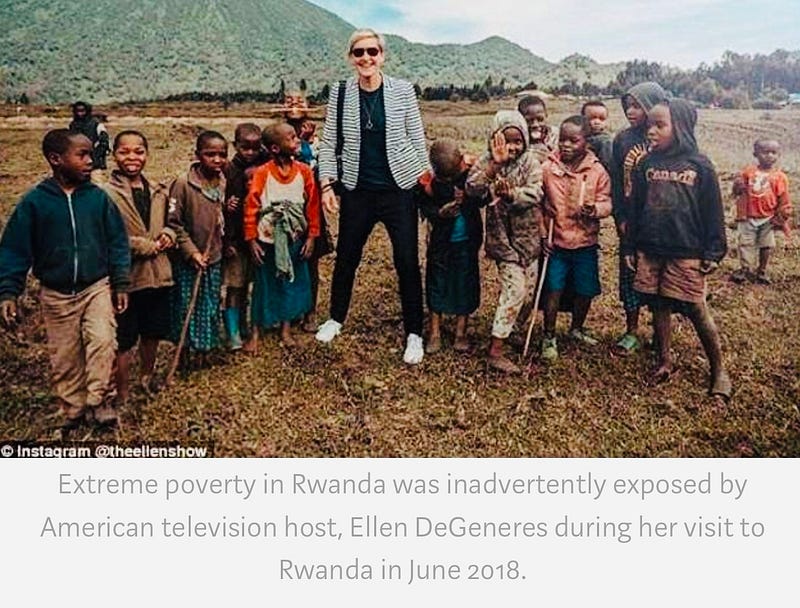

Kagame, as noted above, currently direct tax in Rwanda generates a mere US$576 million a year from 172,988 taxpayers. Motor vehicles number 179,799 — meaning 15 vehicles per 1,000 inhabitants. You are a Banana Republic in urgent need of fighting extreme poverty. These are the types of data Volkswagen should have analyzed. No wonder Volkswagen sold only one VW Polo car in nearly one year.