By David Himbara

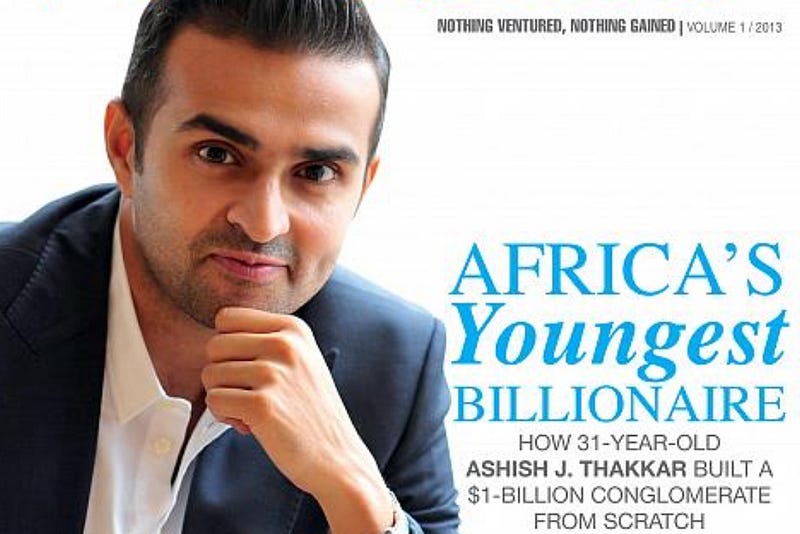

Often referred to as Africa’s youngest billionaire, Ashish Thakkar, a Ugandan businessman, charmed Kagame – and took Rwanda by storm from 2014 onwards. Kagame soon made Thakkar an advisor and a member of his Presidential Advisory Council.

The romance between the president and the billionaire continued to blossom.

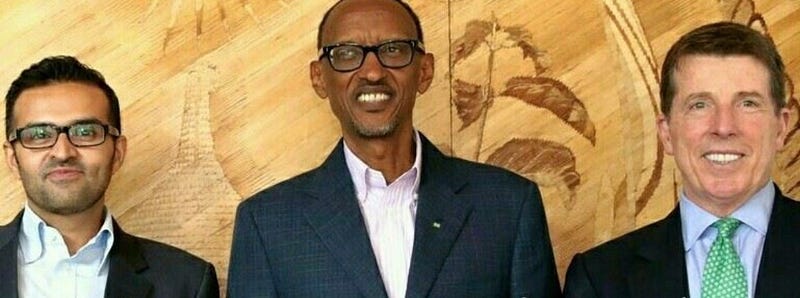

Kagame soon handed over to Thakkar and his partner, Bob Diamond, significant Rwandan public assets. The Rwandan ruler transferred part of Rwanda Development Bank and Banque Populaire du Rwanda (BPR) to the Atlas Mara group owned by Thakkar and Diamond. The trio – Kagame, Thakkar, and Diamond – were now part of the Davos elite who shared the global stage broadcasting stories of transformative banking and ending poverty.

Thakkar then begun to reward Kagame with what the Rwandan ruler loves most – praises and medals.

- In 2014, Thakkar nominated Kagame to the World Entrepreneurship Forum (WEF) for the ‘Policy Maker’ for the 2014 awards. When WEF declined, Thakkar angrily returned the award he himself had received for young entrepreneurship to show solidarity with his newly-found friend, Kagame.

- In 2015, Thakkar described Rwanda as Africa’s ICT Silicon Savannah in his book The Lion Awakes.

- In 2016, Thakkar awarded Kagame’s Rwanda his “Ashish J. Thakkar Global Entrepreneurship Index” for being the most lucrative place for doing business in Africa.

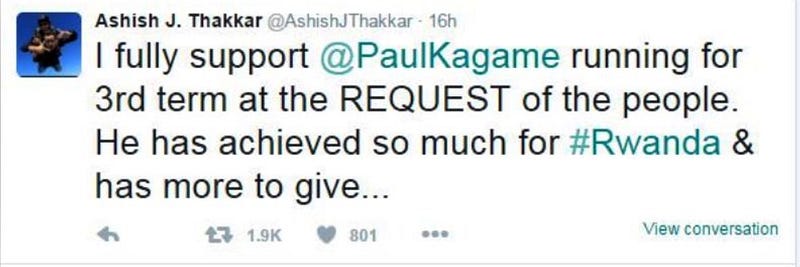

- In 2016, Thakkar supported Kagame’s bid for third presidential term, proclaiming on Twitter that he “fully supported Kagame running for 3rd term at the request of his people…”

Fast-forward to February 2017. The Kagame-Thakkar romance may be in serious trouble. It turns out Thakkar is only half a millionaire – further, his businesses seem to be in shambles. The Wall Street Journal (“Africa’s Youngest Billionaire’ Is Less Successful Than He Seems,” February 2, 2017) described Thakkar as follows:

“Mr. Thakkar told the divorce court last year he doesn’t own Mara Group and his personal assets are worth less than $600,000…Mr. Thakkar and Mara Group, similarly, have hit a rough patch. Atlas Mara Ltd., the African banking group Mr. Thakkar co-founded with Mr. Diamond, lost 78% of its stock-market value in three years.”

So we ask – what due diligence did Kagame undertake to evaluate his partners’ soundness? What might become of the Rwandan financial institutions Kagame handed over to Thakkar and Diamond?

We of course know how the Atlas Mara mess has already affected Rwandans. Barely a year after acquiring BPR from Kagame, Atlas Mara closed 20 of its branches in 2016. An unknown number of Rwandan workers lost their jobs. This is a shame. Prior to the BPR takeover, it was the most accessible banking institution to most Rwandans in rural and urban areas, with 194 branches across the country.

I have previously written on this topic in the past two years. Below are the two pieces I wrote in 2016 and 2015:

Kagame Money Men Have Given Him A Medal

December 9, 2016

In the attached photograph are Kagame money men. Top left in Marc Holtzman. Top right is Bob Diamond. Bottom right is Ashish Thakkar. Meet Kagame money men.

When it comes to controlling money, Kagame does not trust a single Rwandan to assist – he uses his money men.

In control of Bank of Kigali for Kagame is Marc Holtzman, Chairman of the Board and board member since 2009. Before Holtzman took over Bank of Kigali, his protégé Lado Gurgenidze from the Republic of Georgia was the chairman.

Meanwhile, Holtzman’s former boss is Bob Diamond. To Bob Diamond together with Ashish Thakkar, Kagame gave part of Rwanda’s Development Bank and Banque Populaire de Rwanda (BPR). These are the fellows currently tearing BPR apart.

Surprise surprise – now these folks are pronouncing Rwanda to be the top performer.

According to the so-called “Ashish J. Thakkar Global Entrepreneurship Index”, Rwanda is the most lucrative place for business in Africa ahead of such countries as Kenya, Botswana, South Africa and Zambia.

Kagame’s sycophants will be dancing in the streets with this latest medal. But Kagame, Holtzman, Diamond, and Thakkar are laughing all the way to the bank.

Rwanda’s Financial Sector Is A Hollywood Horror Movie

May 2, 2015

Rwanda’s financial sector is a Hollywood horror movie and the plot is thickening by the day. The latest horrific episode is the announcement that Banque Populaire du Rwanda (BPR) is to soon to be taken over and become part of the Atlas Mara Group owned by Bob Diamond, an American banker and former Barclays Bank chief, and his Ugandan partner, Ashish Thakkar.

Diamond and Thakkar already took over the financial arm of the Development Bank of Rwanda (BRD) in 2014.

BRD was already a Hollywood horror film complete with murder long before Bob Diamond and Ashish Thakkar entered the Rwandan scene. Back in 2008, a German business group bought 25% of BRD to use it to build their African Development Corporation (ADC). ADC romance with Rwanda lasted one year ~ they left BRD in 2009. BRD CEO, Theogene Turatsinze resigned and moved to Mozambique where he was later to be murdered.

Back to BPR – who will Diamond and Thakkar find in that Bank? No other than Ephraim Turahirwa, the CEO of the Bank. Turahirwa is the former CEO of Tristar Investment, the ruling party’s conglomerate nowadays known as Crystal Ventures Limited. Kagame has literally planted his own men in every money-making body.

So anyway, who is making these deals behind the scenes? Is it just the CEO of Rwanda Inc working by himself? Is Tony Blair Strategic Advisor to the Rwanda Development Board, whose role is “to significantly increase the level of private investment in Rwanda and to improve deal conversion” assisting? Or advices are sought from elsewhere?

There are other mysterious characters in this horror movie. Check out the Kagame appointees in Bank of Kigali that no doubt wheel and deal in Rwanda’s financial sector.

In 2009, Kagame appointed Lado Gurgenidze, the Chairman of Bank of Kigali. Gurgenidze is a former Prime Minister of the Republic of Georgia, among other things. At the same time Kagame appointed Marc Holtzman a director in the same bank. But here is the most interesting bit. Marc Holtzman served as Vice Chairman of Barclays Capital when Bob Diamond was Barclays Bank’s boss. There can be no doubt therefore that Gurgenidze, Holtzman and Diamond are a network deeply embedded in Rwanda’s troubled and tiny financial sector and directly-linked to the Rwandan head of state.

Why do I say Rwanda’s financial sector is “troubled” and “tiny”? It is troubled because it is not transparent. The shadowy deals and characters are not known to most Rwandans. And yet Rwandan workers and pensioners own the assets we are talking about. For example Rwandan workers hold no less than 25% of the Bank of Kigali through the Rwandan Social Security Fund. But have the Rwandan contributors ever heard of Gurgenidze and Holtzman? And how many Rwandans know the real story behind the newly-announced takeover of BPR? Very few, if any.

The Rwandan financial market is not only murky but tiny – and it is unlikely to grow precisely because it is a black hole unknown to most people. Incredibly, there has been a talk that this weird sector will soon become a financial hub for East Africa. What a wishful thinking. Listed on Kigali Stock Exchange are six companies – Bank of Kigali, Bralirwa, Kenya Commercial Bank, Nation Media Group, Uchumi Markets and Equity Bank. Market capitalization of the Rwandan Stock Exchange is about $4 billion, but if we remove the four listed Kenyan companies, market capitalization drops to about $1 billion.

By comparison, Nairobi Securities Exchange has nearly 70 companies, with a market capitalization of K.Sh2,422 billion or $25.5 billion.