By Duncan Miriri

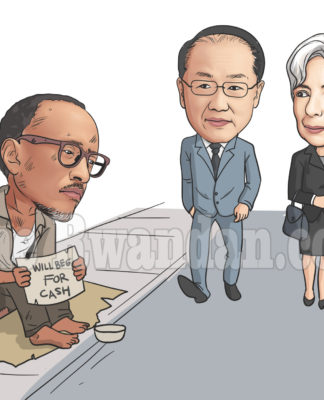

(Reuters) – Western donors must lift an aid freeze on Rwanda, imposed over its alleged support for Congo rebels, to avoid damaging its economy and causing a new crisis in the region, the head of the African Development Bank (AfDB) said.

Rwanda, which relies on donors for about 40 percent of its budget, has recorded robust growth rates in recent years on the back of increased investments and consumption.

But the Central African country’s Finance Minister John Rwangobwa said last week the economy could take a hit after Washington, Berlin and other donors suspended some of their aid over accusations Rwanda was backing M23 rebels fighting in eastern Congo.

Rwandan President Paul Kagame denies the allegations.

Aid to Rwanda should resume “as soon as possible and that means yesterday,” said AfDB president Donald Kaberuka who is Rwandan.

“The damage could be significant and the cost of recovery even higher,” Kaberuka told Reuters in an interview on Thursday, adding the cutting of aid flows could create a crisis in the region.

“There is no reason whatsoever to create an economic crisis in the Great Lakes because that would impact on all the countries in the Great Lakes.”

The economies in the region are closely linked and any slowdown in Rwanda could hit cross-border trade with Burundi and other neighbors.

Kaberuka said the aid cuts risked reversing development in Rwanda’s health, education and other social sectors, achieved as the country tries to recover from the 1994 genocide.

The country’s government says it plan to transform Rwanda into a middle-income country by 2020.

Kaberuka said he had also opposed aid stoppages to Ethiopia in 2006 and to Malawi last year over allegations of human rights abuses.

Kaberuka, who is on his second term at the helm of the Tunis-based bank, said the AfDB is offering Rwanda $45 million in budgetary support this financial year.

He said Sub-Saharan Africa, excluding South Africa, was likely to grow by 6.4 percent next year, buoyed by increased internal demand largely because of urbanization.

The International Monetary Fund sees a 5.4 percent growth for Sub-Saharan Africa this year from 5.1 percent in 2011.

Kaberuka said high prices of commodities like copper and global appetite for investment in Africa would also drive growth.

“The risk appetite for African assets seems to be very strong. The smart money is in Africa so we are cautioning countries, ‘watch issues of access to financial markets, manage debt very well, build debt domestic management,'” Kaberuka said.

The AfDB plans to launch a debut infrastructure bond to raise $22 billion in the second quarter of next year for investment in high-return projects such as power generation.

Kaberuka said the bank was considering guaranteeing Africa’s biggest wind energy generation project, which is expected to generate 300 megawatts from a base in Kenya.

“That is a transformative project for Kenya… if the government of Kenya requests for partial risk guarantees we will be happy to provide,” he said.

Partial risk guarantees promise investors repayment in the case of unforeseen risks like political upheavals. They usually act as an alternative to government guarantees, keeping public debt under control.

(Editing by James Macharia and Andrew Heavens)