By David Himbara

No one in Rwanda can dare read my book, Kagame’s Economic Mirage. The book is banned because it challenges President Paul Kagame’s claims of building the Singapore of Africa. The latest Monetary Policy and Financial Stability Statement released by the National Bank of Rwanda (BNR) on February 22, 2017, confirms what my book demonstrates – Kagame’s economic miracle is fake.

So will Kagame ban the National Bank of Rwanda’s Monetary Policy and Financial Stability Statement, too, for publishing unflattering data? Will Kagame expel the governor of the National Bank of Rwanda, John Rwangobwa, for publishing the report?

The main revelation in the report is financial inclusion in Rwanda. Financial inclusion is defined as the availability of banking services to people with low or non income. Financial inclusion is therefore a key indicator of poor people lifting themselves out poverty.

Take at a look Kagame’s Rwanda in this respect. In 2016, loans to individuals (as opposed to lending to corporate entities) represented 38.8 percent of total loans in Rwanda. The total amount of loans to individuals amounted to FRW 306 billion – equivalent to US$375 million. The breakdown of loans to individuals in 2016 on regional basis was as follows:

1. Kigali City got the lion’s share averaging 73.9 percent of loans to individuals in the last five years;

2. Western Province share of loans to individuals was 7.4 percent;

3. Eastern Province, 7.4 percent;

4. Southern Province, 6.5 percent; and

5. Northern Province, 4.8 percent.

6. In dollars, Kigali’s share of loans to individuals amounted to US$277 million. Rwandans upcountry received loans amounting to only US$98 million.

Remember that the population of Kigali is 1 million, while the rest of Rwanda is 11 million. So 74% of the loans went to some individuals among 1 million Kigalians, while only 26% ended upcountry that has a population of 11 million. The reality of Kagame’s Rwanda, are bad:

1. 95% of Rwandans in Northern Province received zero loans;

2. 92.6% of Rwandans in Eastern Province received zero loans;

3. 92.6% of Rwandans in Western Province received zero loans;

4. 93.5% of Rwandans in Southern Province received zero loans.

Most embarrassing for Kagame is the rate of loan-access by women. Kagame loves to boast about women empowerment during his rule. He brags that women form over 60% of parliamentarians – in a rubber-stamping legislature.

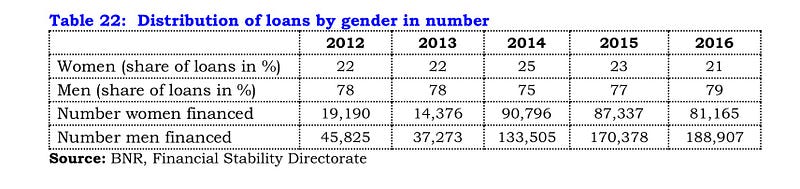

Now take a look at BNR’s table on women access to loans. Women’s share of loans in 2016 was 21% versus 79% for men.

In the words of BNR:

“Loans to individuals represented 38.8 percent (FRW 305.9 billion) of total loans with 21 percent authorized to women and 79 percent to men in 2016. The number of women financed by banks remained low…”

In fact, loan access rate by women in 2016 was lower than in 2012.

So Mr. Kagame, will you ban the National Bank of Rwanda’s Monetary Policy and Financial Stability Statement for exposing you?