By David Himbara

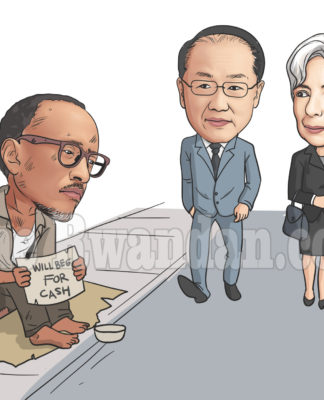

Rwanda’s debt stock leapt from 30.6 percent of the gross national product in 2014 to 78.1 percent in 2020. And now, General Paul Kagame just acquired a new debt of US$620 million. The regime hardly had any other options – the proceeds of the new debt will pay off the US$400 million outstanding debt acquired in 2013 which is due to mature in 2023. With the latest acquisition of a US$620 million debt, it is anyone’s guess as to how this debt crisis will play out.

General Paul Kagame’s government raised US$620 million from investorson July 2, 2021 through the sale of international bonds. The sale was handled by Deutsche Bank and Citigroup. Kagame will use over half the proceeds to pay off the US$400 million Eurobond which was raised in 2013 to build Kigali Convention Centre and buy RwandAir aircraft. The remainder of the US$620 million debt will be spent on “key priority projects.” Kagame previously stated that he used the Eurobond option to build a Covid19 vaccine plant to turn Rwanda into an African hub to supply vaccines to Rwanda and the continent.

Kagame is uncharted territory – the debt levels have raised concerns among Rwanda’s financiers. The Rwanda government’s data shows that debt stock has leapt from 30.6 percent in 2014 to 78.1 percent of the gross domestic product in 2020. In its analysis of July 2021, the International Monetary Fund predicted tough times for Rwanda in the following terms:

“The stress tests indicate that Rwanda’s solvency risks are elevated overall, which makes the country more susceptible to both external and growth shocks compared to December 2020…Compared to the past five years, a higher primary deficit due to the COVID-19 shock is expected to raise public debt regardless of growth recovery.”

Meanwhile, Fitch has revised Rwanda’s outlook from stable to negative. The rating agency said a failure to stabilize the debt at current levels of 70 percent of gross domestic product could lead to a downgrade in the future. But with the latest acquisition of a US$620 million debt, it is anyone’s guess as to how this debt crisis will play out. Stay tuned.