By David Himbara

Dear Bosco H from Kigali, you wanted to know the size of the banking sector in General Paul Kagame’s Rwanda. You also wanted to know how Rwanda’s banking sector compares to Kenyan, Tanzanian, and Ugandan banking sectors.

Bosco H, most importantly, you were right in highlighting the importance of the banking sector in socioeconomic development. Indeed, the banking sector is rightly termed the “lifeblood” of any economy . First, it is the basis for national savings by collecting and growing money that is in turn used to finance development projects. Second, the banking industry lends money not only to individuals, but also provides large-scale loans to governments, businesses, and non-governmental organizations. Third, the banking industry is a major economic sector that employs thousands and drives innovation. As historians point out, in successful economies, the evolution of the banking system preceded economic development. In that sense, the banks are ”locomotives” that pull the entire economy.

So what is the size of the banking sector in Rwanda and how does it compare to its counterparts in Kenya, Tanzania and Uganda?

The central bank in each of the four countries issues an annual financial sector stability report. From these reports, I drew the size of the banking sectors measured by total assets as follows:

- Total assets of Kenya’s banking industry — US$39 billion.

- Total assets of Tanzania’s banking industry — US$12 billion.

- Total assets of Uganda’s banking industry — US$5.3 billion.

- Total assets of Rwanda’s banking industry — US$3 billion.

There you go, Bosco H. Kagame’s economy remains tiny for various reasons, not least because of the size of the banking industry. Kenya’s banking sector is by far the largest, followed by Tanzania and Uganda. Rwanda is the smallest. Not only that — the largest bank in Rwanda, Bank of Kigali (BK), is under Kagame’s direct control.

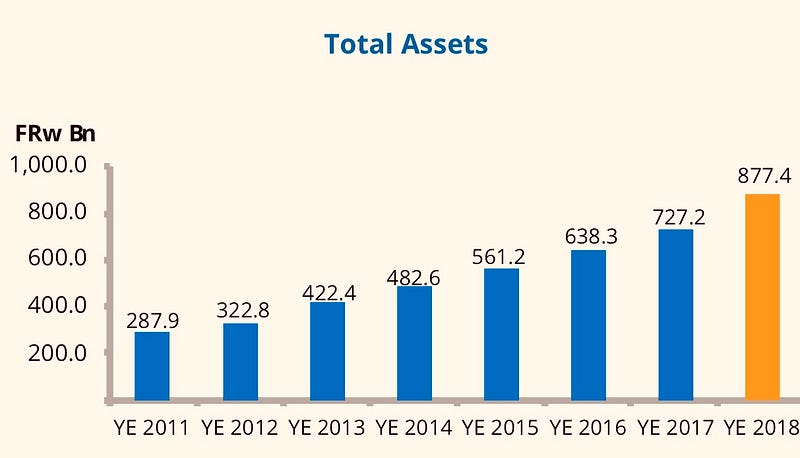

With RWF877.4 billion or US$969 million in total assets, BK is government-owned and was purchased using Rwanda’s pension fund.

With RWF877.4 billion or US$969 million in total assets, BK is government-owned and was purchased using Rwanda’s pension fund.