By David Himbara

General Paul Kagame’s New Times called my critique of the 2019/2020 ”bananas.” In my article, I referred to Kagame’s Rwanda as a Banana Republic because its tax revenues can only finance slightly more than half of its the budget. In the piece in The New Times, it is claimed that there is nothing unusual about that. The New Times article goes on to say that even the US, Japan, the UK, France, and Germany have huge debts. The New Times and its writers have a short memory. Ten years ago, these very rich countries wrote off most of Rwanda’s debt under the Heavily Indebted Poor Countries (HIPC) Initiative. Here is The New Times equating the debts of five most prosperous economies with a HIPC state known as Rwanda. Wonders never cease.

The world’s wealthiest countries are indeed the largest debtor nations on the planet. But the debts of poor nations such as Rwanda are not similar in any form or shape.

When we look at debt as a percentage of the gross domestic product (GDP), Japan is the highest at 234%; US, 105%; France 99%; the UK, 87%; and Germany, 60%. Rwanda’s foreign aid support and loans, however, cannot be compared with the big five. Why not?

My article was not about debt in general but specific debt — namely, foreign aid, foreign loans, and domestic loans that are financing the 2019/20 Rwandan budget. Stripped of domestic borrowing, foreign grants, and foreign loans, the Rwanda regime’s own contribution to the 2019/20 is US$1.7 billion representing 53.4%. In other words, 46.6% will come from domestic borrowing, foreign grants, and foreign loans.

So, is Rwanda in the same league as the US, Japan, the UK, France, and Germany with regards to debt? The answer is a definite no.

Japan is a US$5 trillion dollar economy; the US’s GDP is US$20 trillion; France, US$2.7 trillion; the UK, US$2.8 trillion; and Germany, US$4 trillion. Therefore, these countries are neither poor nor unable to pay their debts. None of these countries need any assistance from the World Bank or the International Money Fund (IMF). In fact, these are the very countries that finance the World Bank and the IMF. They are also the top aid-givers to Rwanda.

The debts of these countries are usually in a variety of notes, bills, and bonds held by foreign governments. According to the US Treasury, for example, the largest foreign holders of US treasury securities are China, US$1.1 trillion; Japan, US$1 trillion; Brazil, US$311 billion; UK, US$276 billion.

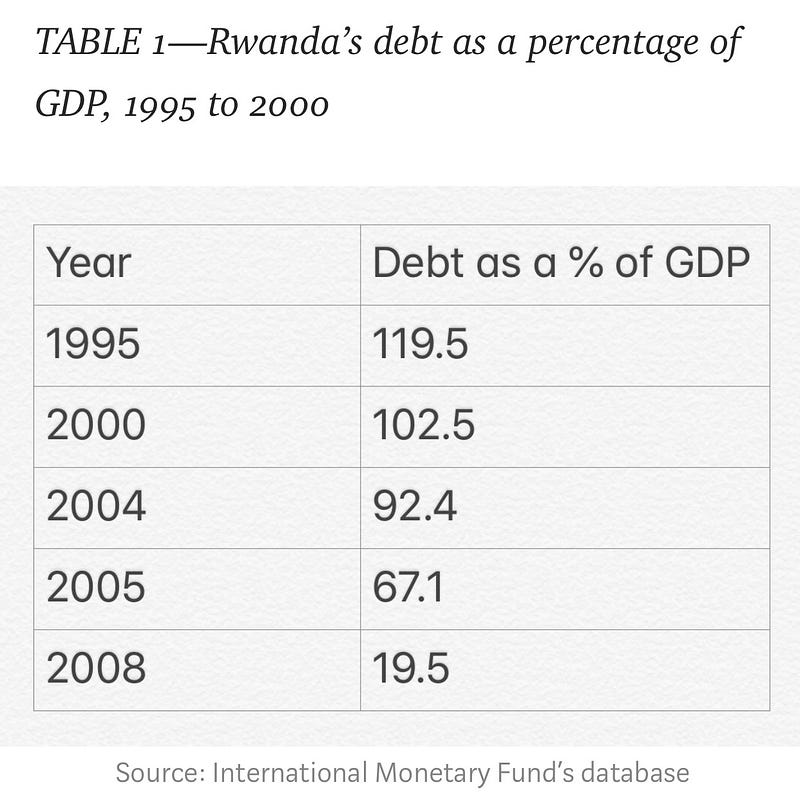

What of Rwanda? Recall that Rwanda was a member of HIPC. Under HIPC Initiative, the larger part of Rwanda’s external was written off between 2000 and 2008. By 2008, donors had struck off US$1.4 Billion from Rwanda’s debt leaving US$688.9 Million. TABLE 1 shows the drastic reduction of Rwanda’s debt measured by the debt-GDP ratio.

As indicated in TABLE 1, Rwanda’s debt was 119.5% of the GDP in 1995, dropping to 19.5% of the GDP in 2008. In other words, while Rwanda’s debt was bigger than its GDP in 1995–2000, the debt was sharply reduced to 19.5% of the GDP by 2008. From 2010 to 2018, however, Rwanda reversed course, accumulating a massive debt. By 2018, Rwanda’s debt had sharply increased to RWF3.9 trillion or US$4.3 billion representing debt/GDP ratio of 49.8%.

Rwanda remains one of the poorest nations in the world with a GDP of US$9.5 billion and a per capita income of US$791. Rwanda is poorer than Haiti, which has a per capita income of US$856. That is why Rwanda can only manage to finance 53.4% of its budget from tax revenues. To compare Rwanda’s debt to those of the US, Japan, UK, France, and Germany is insane. Dear New Times, when last did you hear the US, Japan, UK, France, and Germany joining Rwanda in the Heavily Indebted Poor Countries club?