By David Himbara

Rwanda also outperforms Africa’s economic powerhouses of South Africa, Nigeria and Kenya. Rwanda pays US$30,386 in annual fees for these impressive rankings.

These rankings are featured in the Global Financial Centres Index, the flagship of Z/Yen, a London-based think tank and the China Development Institute based in Shenzhen. The characterization of Rwanda as a top global financial centre can easily make the list of the biggest lies ever told. A closer examination of the Z/Yen- Rwanda relationship unmasks the ranking as propaganda masquerading as a neutral analysis weighing evidence logically and objectively to categorize global financial centres. Far from it – the Rwandan government is one of Z/Yen’s thirteen platinum sponsors who pay an annual fee of US$30,386 or £25,000. The benefits to a platinum sponsor include being featured and marketed among the top global policy and investment decision-makers. Put another way, Z/Yen is a marketing agent for the Rwandan government and its so-called global financial centre.

As shown in Z/Yen’s September 2023 Global Financial Centres Index 34, Rwanda’s financial centre is ranked among fifteen markets “likely to become more significant.” Besides Kigali, the markets in this category include New York, London and Frankfurt. Meanwhile, in Africa, Rwanda is second to Mauritius, outperforming Africa’s economic powerhouses including South Africa, Nigeria and Kenya.

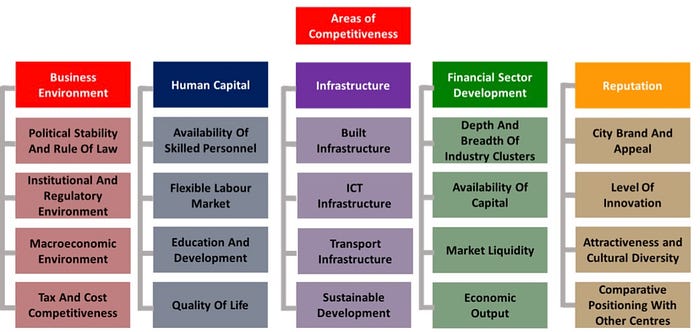

Z/Yen describes itself as the City of London’s leading think-tank with high-powered project managers and technical specialists “so that clients get expertise they need, rather than just resources available.” To rank the global financial centres, Z/Yen uses five broad areas, namely, business environment, human capital, infrastructure, financial sector development and reputation.

Factors used to determine global rankings

To its credit, Z/Yen readily admits that it does not conduct its own field research to determine its rankings. Rather, data from third parties and online questionnaires are the main sources. Z/Yen explains its methodologyin the following terms:

“The quantitative measures are provided by third parties…combined with 53,789 assessments of financial centres provided by 9,097 respondents to the GFCI online questionnaire.”

This approach may work elsewhere but is bound to lead to fraudulent outcomes in the Rwandan context. The respondents to Z/Yen’s online questionnaires are the Kigali International Financial Centre, a government entity that was established in 2020. Relying on the Kagame government to collect and share credible data is like choosing a bank robber to guard a bank. The Financial Times investigation into Rwanda’s statistical manipulation put it best. In Rwanda, “even data must toe Kagame’s line.”

A recent example of Rwanda’s chronic addiction to faking statistics is the case of foreign direct investments (FDI). The World Bank data shows that Rwanda attracted US$398.5 million of FDI in 2022. The UNCTAD’s World Investment Report figure of US$399 million is identical to that of the World Bank. The Rwanda government claimed that it attracted US$1.6 billion FDI in 2022.

Rwanda has neither companies nor specialists for building a financial hub worthy of the name

Rwanda’s financial centre barely exists. A financial centre requires investment managers, pension funds, insurers, hedge funds, and issuers. Rwanda has none of these, as was demonstrated by the Rwanda Innovation Fund (RIF) driven by Kagame’s delusions of transforming Rwanda into a knowledge-based economy. RIF was conceived in 2018 but launched in 2022 as the vehicle for igniting Medtech, Fintech, Edtech, Agritech, and Cleantech.

Revealingly, there was not a single fund manager in Rwanda who could implement RIF’s investing strategy and manage its portfolio startup activities. Angaza Capital was subsequently sourced from Israel to manage RIF funded by AfDB’s US$30 million loan to the Rwandan government. Things didn’t go according to plan, however. AfDB was soon instructing the Rwandan government on steps that “must be undertaken for the project to deliver on its outcomes.” Most critical was the recruitment of a second fund manager. Embarrassingly, the AfDB dictated to the Kagame regime to seek approval from Angaza Capital for recruiting a second fund manager:

“The government of Rwanda must obtain a no objection from Angaza before it can recruit a second FM to the project. Angaza was listed in the Loan Agreement.”

Perhaps, the most compelling evidence that Rwanda’s financial centre is a make-believe is the comparative size of the country’s financial market. Obviously, financial centres grow from financial sectors and capital markets. African financial markets are shown here.

South Africa’s capital market capitalization is US$1.1 trillion versus Nigeria’s US$48.1 billion; Botswana’s US$44 billion; and Kenya’s US$10.6 billion. Sitting near the bottom of Africa’s capital markets, Rwanda’s US$3.1 billion market is in the same league as the war-torn Mozambique’s US$2.8 billion market.

The Global Financial Centre Index unwittingly shows that Rwanda’s financial market is pure fantasy

The financial centres are categorized according to the fees they pay for benefiting from Z/Yen’s work. The top category which includes Rwanda is comprised of thirteen platinum sponsors who pay an annual fee of US$30,386 or £25,000. For this fee, a platinum sponsor accesses Z/Yen’s platforms and global leadership networks of policy and investment decision-makers. Furthermore, a platinum sponsor markets materials s/he wants to be featured on Z/Yen’s platforms and global leadership network. Crucially, each platinum member is profiled on the Global Financial Centre Index in terms of its history, monetary size, outreach, investors, shareholders, and customers.

Profiles of Z/Yen’s platinum sponsors

Looking closely at the profiles of Z/Yen’s platinum sponsors, Rwanda’s financial market is nowhere to be seen. You can’t document a history, monetary size, outreach, investors, shareholders, and customers that do not exist. This is how the Index unwittingly, reveals the fact that Rwanda’s financial market is a fantasy – no further explanation is required.

By way of conclusion, there can be no doubt that Z/Yen is a powerful tool for General Kagame, not least Z/Yen’s self-portrayal as a neutral analyst weighing evidence logically and objectively to categorize global financial centres. Few, if any, know that Kagame pays a fortune of US$30,386 for being ranked above much of Africa. But is the General not embarrassed by the grouping of Rwanda with markets “most likely to become more significant” that include countries such as the US? The last time I checked, the US’s total market capitalization was US$25 trillion versus Rwanda’s US$3.1 billion. Stay tuned.